Credit cards have become an essential financial tool for many individuals, offering convenience, flexibility, and various benefits. However, with the wide array of credit cards available in the market, selecting the right one for your needs can be a daunting task. In this comprehensive guide, we will walk you through the process of choosing the right credit card by considering key factors such as your spending habits, financial goals, and lifestyle requirements. By the end of this article by Seao, you will be equipped with the knowledge and tools necessary to know How to choose the right credit card for your needs an informed decision and select a credit card that aligns with your needs.

How to Choose the Right Credit Card for Your Needs: A Comprehensive Guide

Understanding Your Spending Habits

The first step in choosing the right credit card is to analyze your spending habits. Take a close look at your monthly expenses and identify the categories where you spend the most. Common spending categories include groceries, dining out, travel, entertainment, and shopping. By understanding your spending patterns, you can select a credit card that offers rewards, cashback, or discounts in those specific categories. For example, if you spend a significant amount on groceries, a credit card that provides higher cashback or rewards for grocery purchases would be a suitable choice.

Assessing Your Financial Goals

Your financial goals play a crucial role in How to choose the right credit card for your needs the type of credit card that will best serve your needs. Are you looking to build credit, earn rewards, or consolidate debt? If you are focused on building credit, consider a credit card specifically designed for individuals with limited or no credit history. On the other hand, if you aim to earn rewards, look for cards that offer generous rewards programs, such as travel points, cashback, or airline miles. If consolidating debt is a priority, a balance transfer credit card with a low-interest rate or a promotional 0% APR period could be beneficial.

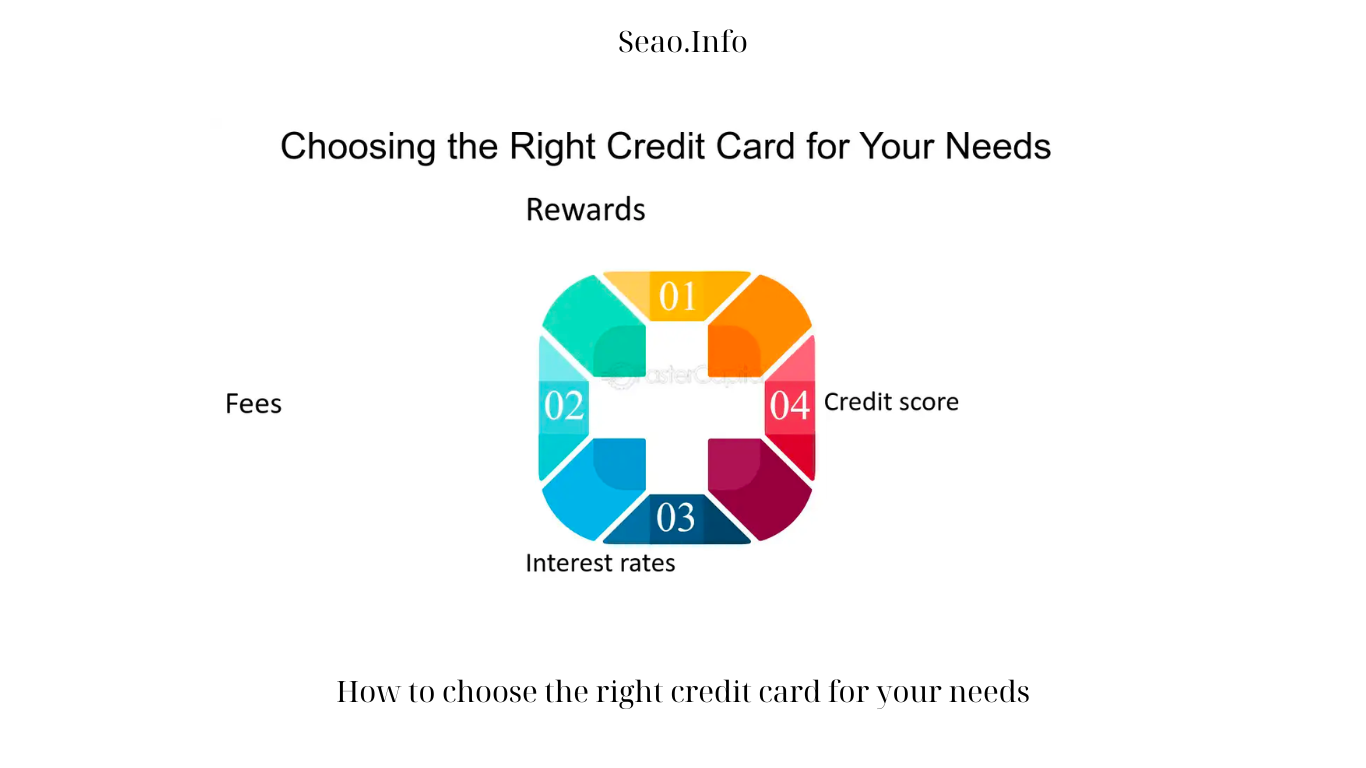

Evaluating Interest Rates and Fees

Credit card interest rates and fees can significantly How to choose the right credit card for your needs your overall cost of borrowing and card ownership experience. It is important to compare the interest rates, annual fees, late payment fees, and foreign transaction fees of different credit cards. If you plan to carry a balance on your credit card, prioritize finding a card with a low-interest rate to minimize interest charges. Additionally, be aware of any annual fees associated with the card and consider whether the benefits and rewards outweigh the cost. Avoiding or minimizing fees can help you maximize the value of your credit card.

Considering Credit Card Rewards and Benefits

Credit card rewards and benefits can How to choose the right credit card for your needs your overall experience and provide additional value. Common rewards include cashback, travel points, airline miles, hotel rewards, and discounts on specific purchases. Evaluate the rewards structure of different credit cards and determine which aligns best with your preferences and lifestyle. For example, if you frequently travel, a credit card that offers travel rewards, airport lounge access, or travel insurance benefits can be advantageous. Make sure to read the terms and conditions of the rewards program to understand any limitations or restrictions on earning and redeeming rewards.

Examining Cardholder Protections and Insurance

Credit cards often come with various cardholder protections and insurance benefits that can offer peace of mind and financial security. These may include purchase protection, extended warranty coverage, price protection, and rental car insurance. Assess the insurance and protection benefits provided by different credit cards and consider how they align with your needs and potential risks. For instance, if you frequently make expensive purchases, a credit card with robust purchase protection and extended warranty coverage can offer added security.

Researching Credit Card Issuers

When choosing a credit card, it is How to choose the right credit card for your needs essential to research the credit card issuer’s reputation and customer service. Look for established and reputable financial institutions that have a track record of excellent customer support and reliable card services. Read reviews and ratings from existing cardholders to gauge customer satisfaction and the issuer’s responsiveness to inquiries and concerns. A credit card from a reputable issuer can provide a smoother and more reliable experience.

Reading and Understanding Terms and Conditions

Before finalizing your decision, carefully in How to choose the right credit card for your needs read and understand the terms and conditions of the credit card. Pay attention to the interest rate, grace period, minimum payment requirements, and any penalties or fees associated with late payments or exceeding credit limits. Understanding the terms and conditions ensures that you are aware of your rights and responsibilities as a cardholder, and helps you avoid any unexpected surprises or financial pitfalls in the future.

Comparing and Making an Informed Decision

After conducting thorough research and considering all the factors mentioned above, it’s time to compare the credit cards that align with your needs. Create a shortlist of the top choices and compare them side by side. Evaluate the key features, rewards programs, fees, interest rates, and benefits of each card. Additionally, consider any introductory offers or promotional deals that may be available. By comparing the pros and cons of each card, you can make an informed decision that suits your financial goals and lifestyle.

Conclusion

Choosing the right credit card for your needs requires careful consideration of multiple factors, including your spending habits, financial goals, and lifestyle requirements. By understanding your spending patterns, assessingyour financial goals, evaluating interest rates and fees, considering credit card rewards and benefits, examining cardholder protections and insurance, researching credit card issuers, and reading and understanding the terms and conditions, you can make an informed decision.

Remember to take your time, conduct thorough research, and compare different credit card options before making a final How to choose the right credit card for your needs. The right credit card can offer valuable rewards, benefits, and financial flexibility, while aligning with your specific needs and preferences. By following the comprehensive guide provided in this article, you can know How to choose the right credit card for your needs navigate the selection process with confidence and choose a credit card that empowers you to achieve your financial goals.