You may require financing to launch or grow your firm, which could include taking out loans from banks or investors or investing your own cash or that of other stakeholders.seao.info‘ll answer this question about business finance loan.

What is business finance loan?

You will likely require access to finance through business financing someday unless your company has Apple-level financial strength. Even many large-cap businesses frequently request financial injections to meet their short-term responsibilities. Finding a business finance loan is essential for small businesses. If you borrow money from the wrong person or organization, you risk losing a portion of your business or being subjected to repayment terms that will hinder your business’s growth for years to come.

Types of finance – business finance loan

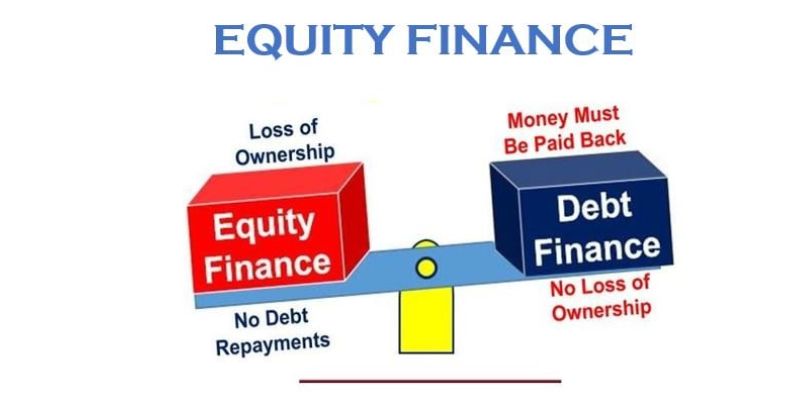

Two of the main types of finance – business finance loan:

Debt finance is the borrowing of funds from outside lenders like banks.

Equity financing is when you invest your own money or money from other stakeholders in return for a portion of the company. Both forms of financing can exist in your company.

Both forms of financing can exist in your company.

To make sure you are obtaining the greatest financing conditions, it is advised that you check your relationship with your lender once a year.

Debt finance

Advantages – business finance loan

- Your company is still entirely under your control.

- Tax deductions are available for loan interest

- Long or short term business finance loan both possible.

Disadvantages – business finance loan

- Loans have set repayment terms that must be adhered to.

- Following the loan’s approval, repayments will start right away.

- Business finance loan is frequently backed by collateral, which could be either the owner’s possessions or the company’s assets.

- Due to the cash flow depletion caused by loan repayment, expanding the firm may be challenging.

Sources of equity finance

The main sources of debt finance:

Financial institutions – credit unions, banks, and building societies. Lending options include loans, overdrafts, and credit lines.

Retailers – using a finance company’s store credit to purchase things for your company. Store cards may have high interest rates, but some merchants offer a grace period during which there is no interest.

Finance companies – most financial institutions provide financial goods through a retailer. Registration with the Australian Securities and Investments Commission (ASIC) is required for financial businesses.

Suppliers – trade credit enables you to put off paying for purchases.

Factor companies – also known as debtor’s financing. A company engages in factoring when it sells its accounts receivable (invoices) to an outside entity (referred to as a factor) in order to get cash without having to wait the customary 30 or 60 days for client payment. Customers pay the factoring provider directly for their invoices. You should do your homework before signing any agreements because the price for delivering this service varies between businesses.

Invoice finance – Similar to factoring in many ways, however invoices are paid directly to your company, and clients are kept in the dark about your financial arrangements.

Peer-to-peer lenders connect those asking for a loan with those with money to invest. Loan terms may include a deadline for repayment and a range of interest rates depending on the degree of risk.

Family or friends – may offer to lend you money. It is crucial to have a clear written agreement outlining the loan terms, repayment criteria, and interest rates in order to prevent misunderstandings. Consult a lawyer to draft the loan agreement.

Equity finance – business finance loan

Advantages

- Less dangerous than a loan because the investment does not require immediate repayment.

- Profits don’t have to be spent to pay back the loan, so you’ll have extra cash on hand.

- The investor(s) may give your company more credibility and skill sets.

Disadvantages

- The investor(s) will demand a stake in your company or a controlling interest in it, and they’ll want to participate in business decisions.

- Finding the perfect investor for your business requires time and effort.

Sources of debt finance

Personal finances – Your business will be self-funded via savings or the sale of personal belongings.

Venture capitalists – professional investors that invest large funds into businesses (as equity) with potential for high growth and profit.

Family or friends – may provide funds in return for a share in your business or as a partnership. Carefully consider this option as a breakdown in business relationships may affect your personal relationships. Read our guide: Starting a business partnership for more information.

Private investors – also known as ‘business angels’ are generally wealthy individuals who invest large sums of money in a business in return for equity and a share of the profits.

Crowd funding – a huge group of people working together to raise money, usually online through social media or crowd financing websites. It enables investors to contribute substantial sums in exchange for stock or small sums in consideration for an early-access product or another benefit.

Crowd-sourced equity funding – a kind of public financing for new companies and small businesses. Typically, they rely on a large number of investors contributing tiny sums. Each investor may put up to $10,000 per year into a business, in exchange for which they will receive shares.

Government – The majority of government support for small businesses comes in the form of free or inexpensive advice, information, or direction. However, under specific conditions, such as business expansion, R&D, innovation, or exporting, you can be qualified for a grant.

Hope you will gather basic information about business finance loan. Through the above article, I believe that you will come up with a suitable solution for your business.