In today’s fast-paced world, managing finances efficiently has become more important than ever. One of the most effective ways to boost your savings and improve your financial health is by cutting down on unnecessary expenses. But identifying and reducing such expenses is not always straightforward. This comprehensive guide provides practical Tips for Reducing Unnecessary Expenses and enhance your financial well-being.

Understanding Unnecessary Expenses

Unnecessary expenses are costs that do not contribute to your overall wellbeing or long-term goals. They often include impulsive buys, luxury items beyond your means, or services that don’t add significant value to your life. Recognizing these can be the first step towards achieving a healthier financial state.

1. Track Your Spending

Before you can cut down on unnecessary expenses, you need to know where your money is going. Start by tracking all your expenditures for at least a month. Use budgeting apps, spreadsheets, or simply pen and paper to note every purchase, no matter how small. This exercise will help you identify spending patterns and pinpoint areas where you can cut back.

2. Set a Budget

Once you’ve tracked your spending, create a budget that reflects your financial goals. Allocate amounts for your needs (rent, utilities, groceries), savings, debts, and wants. Be realistic with your budget to ensure it’s sustainable. Stick to this budget diligently to keep your spending in check.

3. Prioritize Your Expenses

Classify your expenses into essential and non-essential categories. Essentials include rent, groceries, health care, and transportation. Non-essentials could be eating out, subscriptions, and luxury items. Focusing on essentials and cutting back on non-essentials can significantly reduce your unnecessary spending.

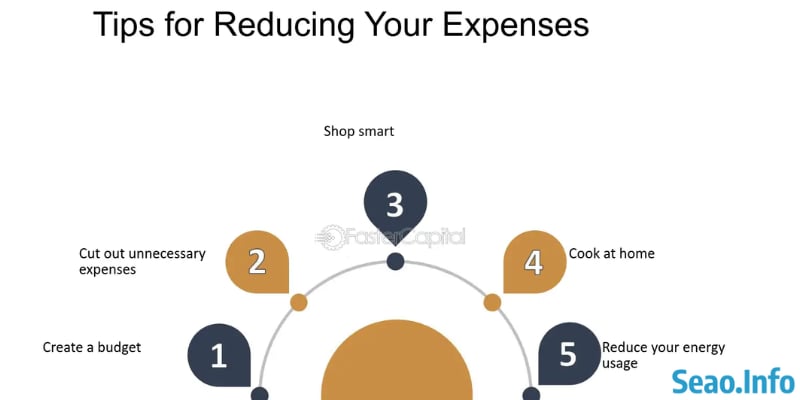

Tips for reducing unnecessary expenses

1. Dining Out

Eating out frequently can drain your wallet more than any other non-essential activity. To cut back:

- Limit restaurant visits to special occasions.

- Opt for cooking at home, which is more economical and often healthier.

- When you do eat out, look for discounts or choose less expensive restaurants.

2. Subscriptions and Memberships

Many of us sign up for subscriptions and memberships that we rarely use. Review all your recurring charges and ask yourself:

- Do I use this service regularly?

- Is there a cheaper or free alternative?

- Can I share this service with someone to split the cost?

Cancel any service that doesn’t provide enough value for its cost.

3. Impulse Purchases

Impulse buying, especially online, can quickly add up. To avoid it:

- Implement a waiting period (like 48 hours) before buying anything outside your planned purchases.

- Unsubscribe from marketing emails to reduce temptation.

- Use wish lists to evaluate if you really need the item later.

4. Utilities and Household Expenses

Reducing the cost of utilities and other household expenses can save a lot in the long run. Try these tips:

- Switch to energy-efficient appliances and light bulbs.

- Reduce water usage with low-flow fixtures.

- Adjust your thermostat a few degrees to save on heating and cooling.

5. Transportation Costs

Owning and maintaining a vehicle can be expensive. Consider alternatives to reduce these costs:

- Use public transportation where available.

- Carpool with coworkers or friends.

- Keep your vehicle well-maintained to avoid costly repairs later.

6. Expensive Habits

Whether it’s smoking, buying designer clothes, or going to high-end gyms, expensive habits can consume a significant portion of your budget. Cutting back on these can make a huge difference. Look for cheaper or free alternatives that fulfill the same needs.

Adopting a Minimalist Lifestyle

Adopting a minimalist approach can naturally curb your tendency to overspend. Minimalism emphasizes the value of simplicity and focuses on having fewer but more meaningful possessions and experiences. Here’s how you can incorporate minimalism into your life:

- Declutter your home and sell or donate items you no longer use.

- Before purchasing, ask if the item adds value to your life.

- Focus on quality over quantity to avoid frequent replacements.

Utilizing Technology to Reduce Costs

Technology can be a powerful tool in managing and reducing your expenses:

- Use budgeting apps to keep track of your spending and stay within budget.

- Set alerts for bills and subscriptions to avoid late fees and unwanted renewals.

- Compare prices online before making a purchase to ensure you are getting the best deal.

Building and Maintaining Good Financial Habits

1. Save First

Make it a habit to save a certain percentage of your income at the beginning of the month, treating it as a non-negotiable expense. Over time, this will build a substantial nest egg and reduce the temptation to spend excessively.

2. Educate Yourself About Finances

Understanding financial basics such as investing, the power of compounding interest, and debt management can significantly improve your spending decisions. Regularly read books, articles, and watch seminars on financial literacy.

3. Set Financial Goals

Having clear, achievable financial goals can motivate you to cut unnecessary expenses. Whether it’s saving for a down payment on a house, preparing for retirement, or building an emergency fund, keep your goals in sight to stay focused.

Conclusion

Reducing unnecessary expenses requires a consciential effort, self-discipline, and a commitment to your financial goals. By understanding your spending habits, making informed decisions, and adopting healthier financial practices, you can effectively manage your expenses, increase your savings, and improve your overall financial health. Start implementing these tips today and observe how your financial landscape transforms, paving the way to a more secure and fulfilling life.