Recessions can be challenging times for individuals and families alike so that you’ll need the tips for managing personal finances during a recession. During economic downturns, it becomes crucial to adopt effective strategies to manage personal finances and navigate the turbulent financial landscape. In this comprehensive guide, Seao will provide valuable tips and insights on how to successfully manage your personal finances during a recession. By implementing these tips for managing personal finances during a recession, you can protect your financial well-being and emerge stronger from challenging economic times.

Tips for Managing Personal Finances During a Recession: A Comprehensive Guide

- Understand the Impact of a Recession:

The first Tips for managing personal finances during a recession in managing your personal finances during a recession is to gain a solid understanding of what a recession entails. A recession is a period of economic decline characterized by reduced economic activity, rising unemployment rates, and decreased consumer confidence. Recognizing the signs and implications of a recession will help you prepare and make informed financial decisions. - Assess Your Financial Situation:

Conduct a thorough assessment of your current financial situation is the second Tips for managing personal finances during a recession. Evaluate your income, expenses, assets, and liabilities. This analysis will provide you with a clear picture of your financial standing and help identify areas that require attention. Understanding your financial position will enable you to make informed decisions and prioritize your financial goals during a recession. - Create a Budget and Stick to It:

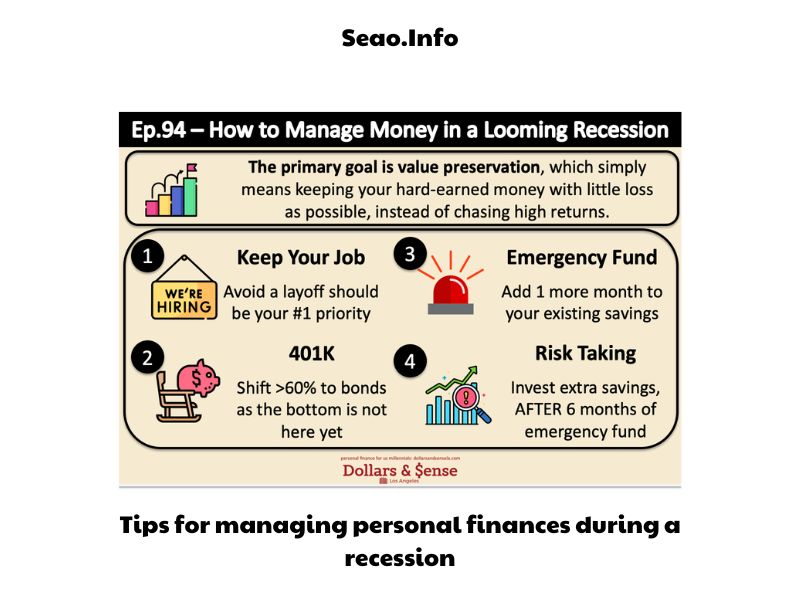

Developing a comprehensive budget is one of the Tips for managing personal finances during a recession that essential for managing personal finances effectively during a recession. Start by tracking your income and expenses meticulously. Identify areas where you can make cuts or reduce spending. Allocate a portion of your income towards savings and emergency funds. Regularly review and adjust your budget as necessary to stay on track. - Build an Emergency Fund:

During a recession, having an emergency fund is crucial and this is one of the best Tips for managing personal finances during a recession. Aim to save at least three to six months’ worth of living expenses in a separate account. This fund will provide a financial safety net in case of unexpected job loss or other emergencies. Make saving a priority, even if it means making temporary sacrifices in non-essential areas of your budget. - Minimize Debt and Manage Credit:

Recessions can make it challenging to manage debt due to potential job loss or reduced income. Focus on minimizing debt by paying off high-interest loans and credit card balances is one of essential Tips for managing personal finances during a recession. Avoid taking on new debt unless absolutely necessary. Additionally, manage your credit wisely by paying bills on time and maintaining a good credit score, which can be beneficial in obtaining favorable terms on future loans.

- Diversify Your Income Sources:

Relying solely on a single source of income can be risky during a recession. Explore opportunities to diversify your income by developing additional streams of revenue also one of Tips for managing personal finances during a recession. Consider freelancing, part-time work, or monetizing your skills and hobbies. Diversifying your income sources can provide stability and financial resilience during economic uncertainties. - Prioritize Essential Expenses:

During a recession, it is essential to prioritize essential expenses to ensure your basic needs are met. Review your expenses and identify areas where you can cut back without compromising your well-being. Evaluate subscriptions, discretionary spending, and entertainment expenses to find areas where you can make adjustments. - Seek Professional Financial Advice:

If you feel overwhelmed or uncertain about managing your finances during a recession, consider seeking professional financial advice. Consult a certified financial planner or advisor who can provide guidance tailored to your specific circumstances. They can help you develop a personalized financial plan and offer insights on investment strategies, risk management, and long-term financial goals. - Stay Informed and Adapt:

Keeping yourself informed about economic trends and government policies is crucial during a recession. Stay updated on industry developments, job market conditions, and financial news. Adapt your financial strategies accordingly to make informed decisions. Being proactive and flexible in managing your finances can help you navigate the challenges of a recession more effectively. - Focus on Long-Term Financial Goals:

While it can be tempting to focus solely on short-term financial concerns during a recession, it’s important not to lose sight of your long-term goals. Stay committed to your retirement savings, investment plans, and other financial objectives. By maintaining a long-term perspective, you can ensure that your financial decisions align with your overall financial well-being.

Conclusion

Managing personal finances during a recession requires careful planning, discipline, and adaptability. By following these comprehensive Tips for managing personal finances during a recession, you can navigate economic downturns with confidence and protect your financial stability. Remember to assess your financial situation, create a budget, build an emergency fund, minimize debt, diversify your income, and prioritize essential expenses. Seek professional advice when needed and stay informed about economic developments. By implementing these strategies, you can weather the storm of a recession and position yourself for long-term financial success.