Investing in mutual funds can be an excellent way to grow your wealth and achieve your financial goals. However, if you’re new to the world of investing, understanding the basics of mutual funds is essential. In this beginner’s guide, we will demystify mutual funds, providing you with a solid foundation to embark on your investment journey. From defining what mutual funds are to exploring their types, benefits, and risks, we will cover all the fundamental aspects you need to know. So, whether you’re looking to build your retirement savings or grow your wealth over time, join Seao as we delve into the world of mutual funds and equip you with the knowledge to make informed investment decisions.

Understanding the Basics of Mutual Funds: A Beginner’s Guide

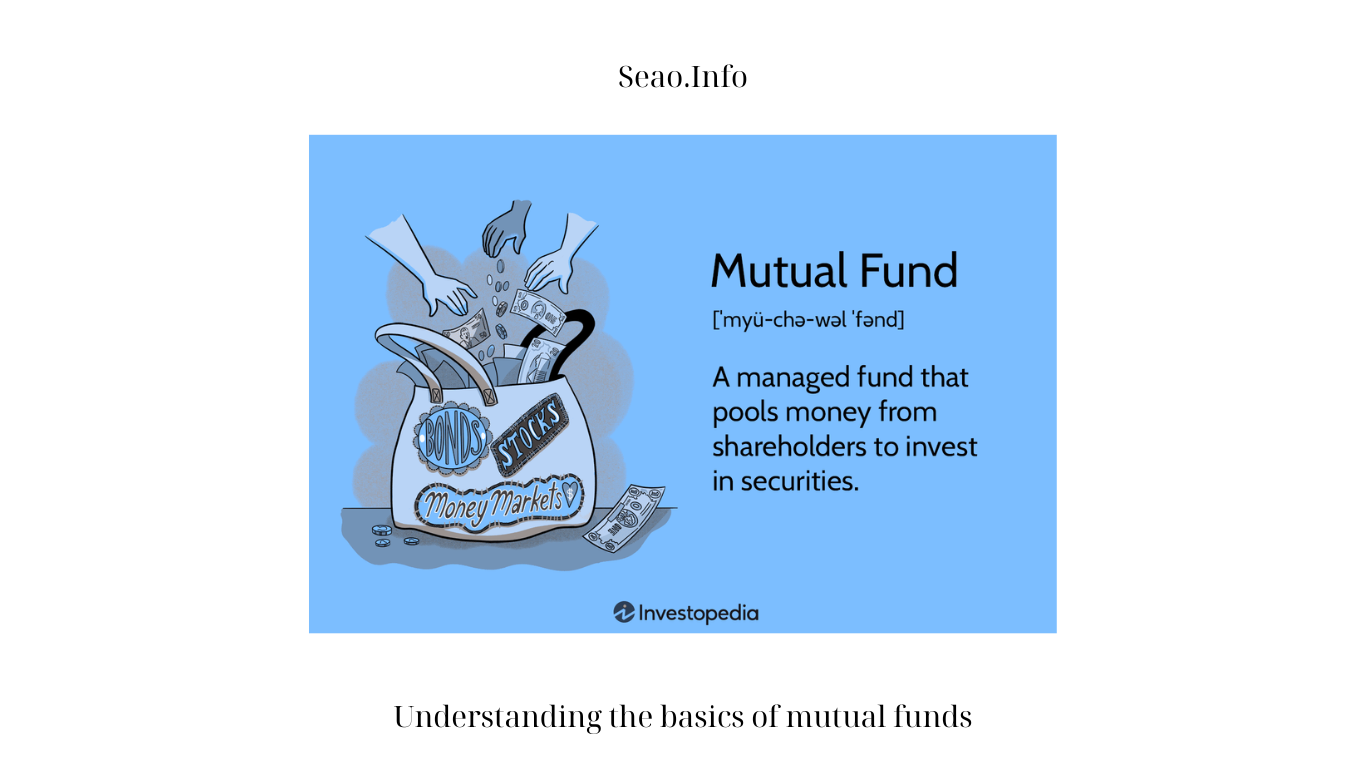

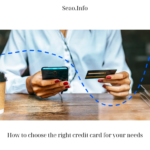

- What Are Mutual Funds?

To Understanding the basics of mutual funds, we need to start with the basics. This section provides a clear definition of mutual funds, explaining how they pool money from multiple investors to invest in a diversified portfolio of securities. We explore the role of fund managers in managing the investments and highlight the key features that make mutual funds an attractive investment option.

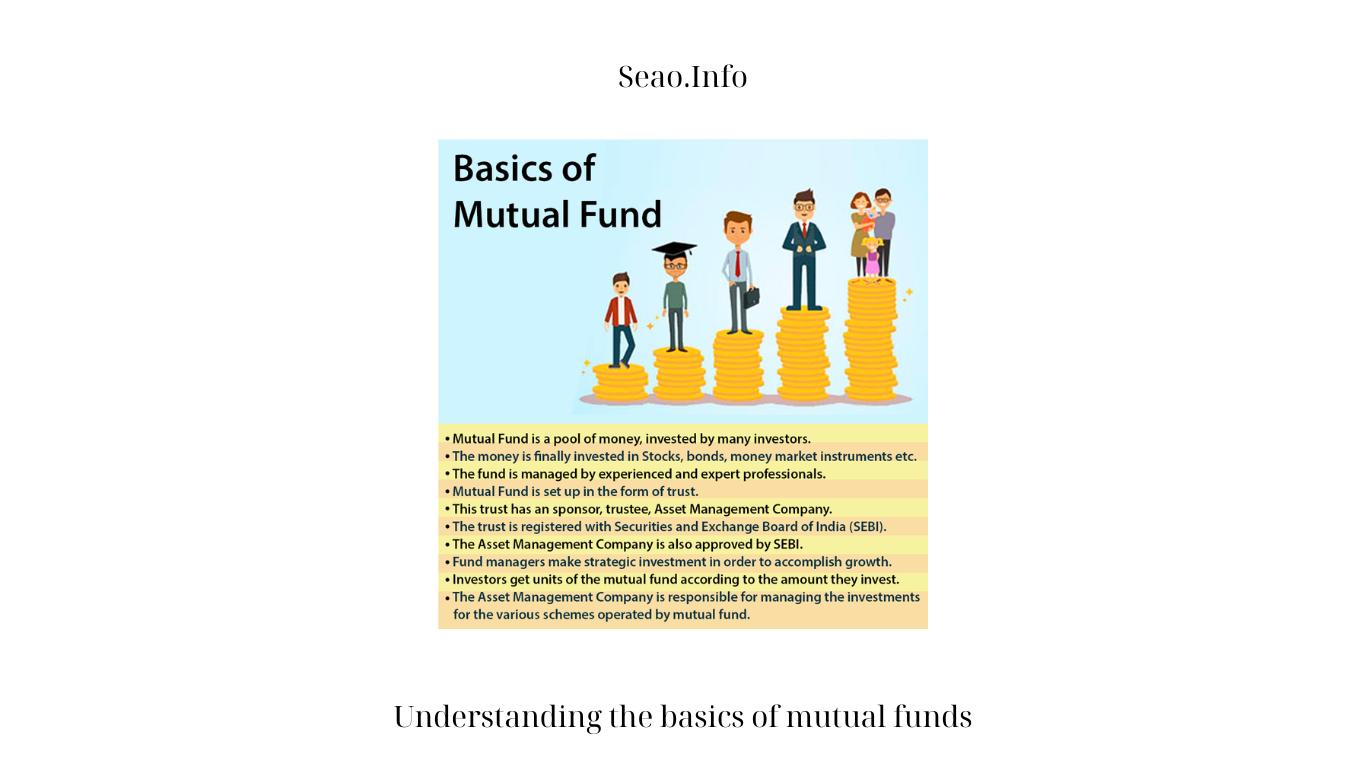

- Types of Mutual Funds

Mutual funds come in various types, each with its investment objective and strategy. This section provides Understanding the basics of mutual funds an overview of the most common types of mutual funds, including equity funds, bond funds, balanced funds, index funds, and sector-specific funds. We discuss the characteristics and potential benefits of each type, helping you understand which may align with your investment goals.

- How Do Mutual Funds Work?

Understanding how mutual funds operate is vital for investors. This section explains the Understanding the basics of mutual funds structure of mutual funds, including the creation of shares, the net asset value (NAV), and the process of buying and selling mutual fund shares. We also touch upon concepts such as expense ratios, dividends, and capital gains distributions.

- Benefits of Mutual Funds

Mutual funds offer several advantages that Understanding the basics of mutual funds make them appealing to investors. This section highlights the key benefits, such as diversification, professional management, liquidity, and accessibility. We discuss how mutual funds can help reduce risk, save time, and provide exposure to a wide range of investment opportunities.

- Risks Associated with Mutual Funds

While mutual funds have their advantages, they also come with inherent risks. This section explores the potential risks investors should be aware of, including market risk, liquidity risk, and interest rate risk. We emphasize the importance of understanding these risks and conducting thorough research before investing in mutual funds.

- Choosing the Right Mutual Fund

Selecting the right mutual fund is Understanding the basics of mutual funds crucial for achieving your investment objectives. This section provides guidance on evaluating and comparing mutual funds based on factors such as investment strategy, historical performance, expense ratios, and fund managers’ track records. We also discuss the importance of aligning the fund’s objectives with your risk tolerance and investment horizon.

- Investing in Mutual Funds

This section walks you through the process of investing in mutual funds. We discuss different avenues for investing, including direct investment through fund companies, investment platforms, and financial advisors. We also address the importance of setting realistic expectations, establishing an investment plan, and monitoring your portfolio regularly.

- Understanding Fees and Expenses

Mutual funds come with various fees and expenses that investors should be aware of Understanding the basics of mutual funds. This section explains common charges such as sales loads, management fees, 12b-1 fees, and redemption fees. We provide insights into how these fees can impact your investment returns and the significance of considering cost-effective options.

- Monitoring and Reviewing Your Mutual Funds

Once you invest in mutual funds, it is essential to monitor and review your investments periodically. This section discusses the importance of staying informed about your fund’s performance, conducting regular portfolio reviews, and making adjustments when necessary. We also touch upon the significance of rebalancing your portfolio to maintain your desired asset allocation.

- The Role of Mutual Funds in Financial Planning

Mutual funds can play a vital role in your overall financial plan. This section explores how mutual funds can align with your financial goals, such as retirement planning, saving for education, or achieving specific milestones. We emphasize the importance of integrating mutual funds into a comprehensive financial plan and seeking professional advice, if needed.

Conclusion

Understanding the basics of mutual funds is the first step toward becoming a confident and informed investor. By grasping the key concepts, types, benefits, and risks associated with mutual funds, you have laid the groundwork for making sound investment decisions. Remember to conduct thorough research, align your investment objectives with the right mutual funds, and regularly review your portfolio.

Investing in mutual funds can be an effective tool for building wealth and achieving your financial goals, but it requires patience, discipline, and ongoing education. With this beginner’s guide as your foundation, you are well-equipped to embarkon your investment journey and navigate the world of mutual funds with confidence.